Case Study 1: Tests for Qualifying ChildrenJane, 31, and Todd, 33, have an 8-year-old child, Amanda. Jane and Todd have never been married. Jane and her child Amanda lived together all year in an apartment. Todd lived alone. Jane earned $15,000 working as a clerk in a clothing store. Todd is an assistant manager of a hardware store and earned $48,000. He paid over half the cost of Jane's apartment for rent and utilities. He also gave Jane extra money for groceries. Todd does not pay any expenses or support for any other family member. All are U.S. citizens and have valid SSNs. Although Todd did provide over half the cost of a home for Jane and Amanda, he cannot file Head of Household since Amanda did not live with him more than half the year. Jane cannot file Head of Household either. Review the Filing Status for Head of Household rules in the Volunteer Resource Guide, Tab B, Filing Status.. Who can claim Amanda as a qualifying child for EIC? Click here for an explanation. Jane is the only one who can claim Amanda as a qualifying child for EIC. Todd cannot since Amanda did not live with him for more than half the year. Review the Earned Income Credit rules in the Volunteer Resource Guide, Tab I, Earned Income Credit.

|

Earned Income Credit (EIC) Workout

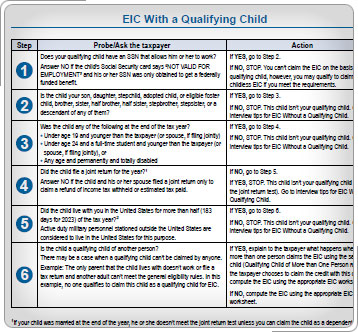

Rules for Taxpayers with Qualifying Children

Filing Status for Head of Household Rules

Earned Income Credit Rules