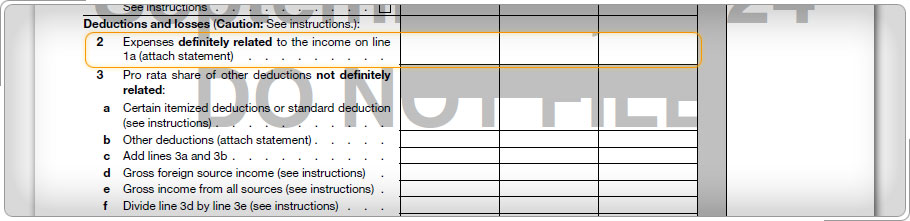

Part I (continued)Line 2: DeductionsWhen computing taxable income from foreign sources for the foreign tax credit, subtract foreign income-related expenses, losses, etc., from foreign income. On line 2, enter deductions that are definitely related to the foreign income such as expenses incurred to move to a new principal place of work outside the U.S. For tax years 2018 to 2025, moving expenses are no longer deductible unless you are a member of the Armed Forces on active duty.

|