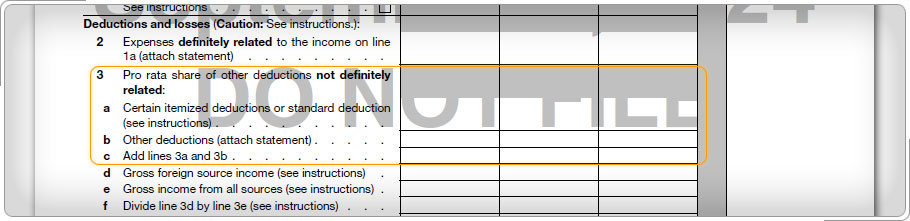

Part I (continued)Line 3: DeductionsOn lines 3a and 3b, enter deductions that are not definitely related to specific income, such as:

Alimony (income and deduction) for divorce or separation instruments (or amendments) executed after December 31, 2018 was revoked. The deduction for alimony payments was eliminated for divorce or separation agreements executed or modified after December 31, 2018.

|