Which Forms?

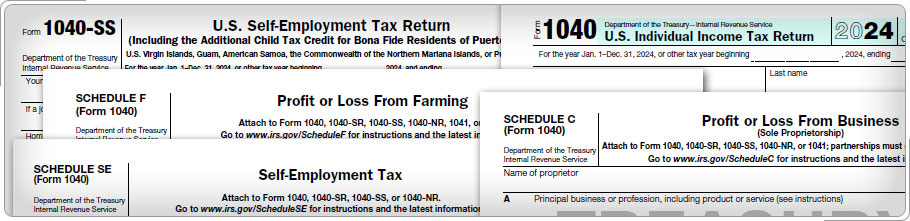

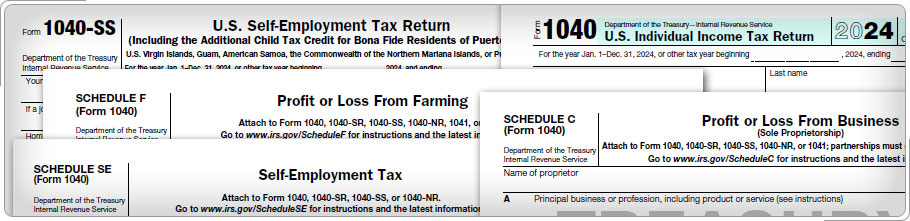

Residents of Puerto Rico use the following forms to report self-employment income earned in Puerto Rico and compute the self-employment tax due:

- Form 1040-SS (English) or Form 1040-SS (SP) (Spanish) if they do not have income subject to U.S. tax. Include Schedule C, F, and SE, as applicable.

- Form 1040-SS and Form 1040-SS (SP) can also be used to claim the refundable child tax credit.

- Form 1040, Schedule C, and Schedule SE if they have income subject to U.S. tax.

- At the bottom of Schedule C and Form 1040, write "For self-employment tax only" to indicate that this self-employment income is not subject to U.S. tax as it's excluded under IRC 933. Enter 0 on Schedule 1, line 3 (Business Income).

- Taxpayers who file Form 1040 use Schedule 8812 to claim the refundable child tax credit.

- Caution: Do not file a Form 1040-SS and a Form 1040 for the same taxpayer on the same tax year.