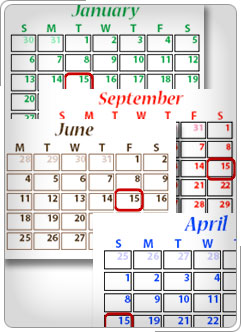

Estimated Tax$1,000 or More in TaxesTaxpayers generally have to make estimated tax payments if they expect to owe $1,000 or more when they file their return. Estimated taxes are due on the following dates (or next business day if these dates fall on weekends or holidays):

|