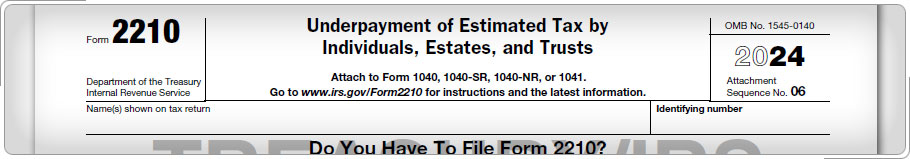

Estimated Tax (continued)Penalty for UnderpaymentUsually, taxpayers make four equal payments. If they do not owe tax for the first due date, or they start doing business in the middle of the year, they should make estimated tax payments for the remaining quarters. Taxpayers who do not make their required estimated payments may be penalized for underpayment of estimated tax. Use Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, to compute the penalty. The rate is determined each year using the prevailing interest rate on certain dates during the tax year.

|