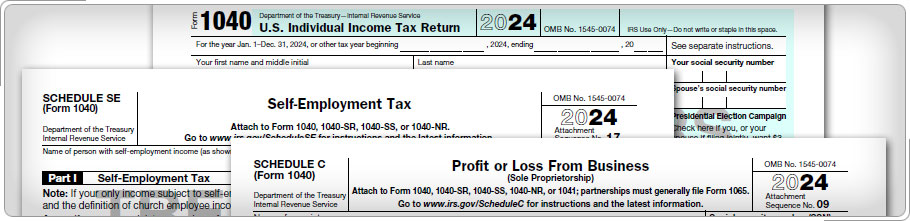

Which Forms? (continued)Case Study (continued)The Reals earn income from Judith's job at the Banco de Hato Rey and Nick's work as a self-employed carpenter. They have self-employment income but no income subject to U.S. income tax, so you can use Form 1040-SS(SP) (Spanish) or Form 1040-SS (English) along with the applicable schedules. For taxpayers with income subject to U.S. income tax as well as self-employment income earned in Puerto Rico, complete Form 1040, Schedule C, and Schedule SE.

|