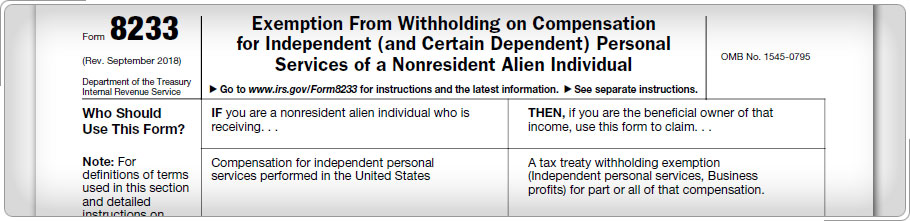

Wages, Salaries, and Tips (continued)Some tax treaties allow a limited exemption from tax for wages earned while temporarily studying in the U.S. To avoid withholding on wages eligible for the exemption, a student should fill out Form 8233, and give three copies to the employer. If a student fails to give Form 8233 to the employer, or earns more than the treaty exemption amount, federal tax will be withheld and amounts earned will be reported on Form W-2, Wage and Tax Statement. However, treaty provisions can still be claimed on the tax return. Income not subject to withholding because of a treaty is reported on Form 1042-S, Foreign Person's U.S. Source Income Subject to Withholding. This is reported on the Form 1040-NR line for Total Income Exempt by a Treaty from Schedule OI. See Publication 4011 for details.

|

Nonresident Income and Deductions

Taxation of Nonresidents

Form 1042-S