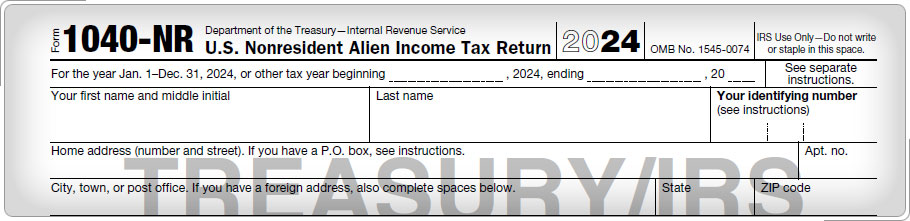

Effectively Connected IncomeNonresident alien students and/or scholars are considered to be engaged in a U.S. trade or business if they are studying, teaching, or doing research. Income from such activities is "effectively connected" and must be reported on Form 1040-NR. This income is taxed at the same rates applicable to U.S. citizens and resident aliens. Income that is not effectively connected must be reported on Form 1040-NR. No deductions can be taken against it, and it is taxed at a flat rate of 30 percent, unless a lower treaty rate applies.

|