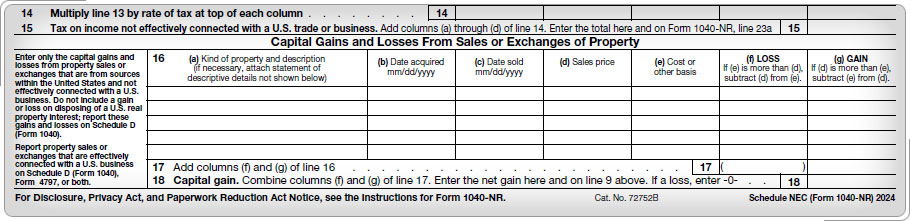

Capital Gain or LossNonresident alien students and scholars are subject to 30 percent taxation of U.S. capital gains, unless a tax treaty allows a lower rate. Report this income in the Capital Gains and Losses From Sales or Exchanges of Property section of the 1040-NR. If a sale of stock takes place, it should be reported regardless of whether a gain or loss occurs. Refer to Publication 901, U.S. Tax Treaties for the table that lists the income tax rates on capital gains. Sales of stock and other capital gain issues should be handled only by tax preparers who have certified at the advanced level. The types of capital gains and losses within the scope of the VITA/TCE Foreign Student and Scholar program may be further limited, see Publication 4011.

|