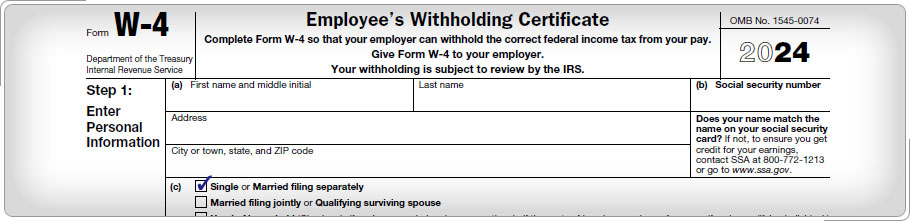

Wages, Salaries, and TipsWages are generally subject to tax withholding by the employer. Upon being hired, an employee files Form W-4, Employee's Withholding Certificate to advise the employer of the employee's status for withholding. A nonresident student should check the "Single" box on Form W-4, even if married, due to the restrictions on deductions that can be claimed by nonresidents. The Withholding Estimator found on www.irs.gov does not calculate for Non-Resident Alien at this time. Therefore, the proper amount of tax divided by the number of pay periods should be added to Form W-4, Line 4c extra withholding. This should account for nonresident aliens who do not qualify for the standard deduction. Use Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens.

|