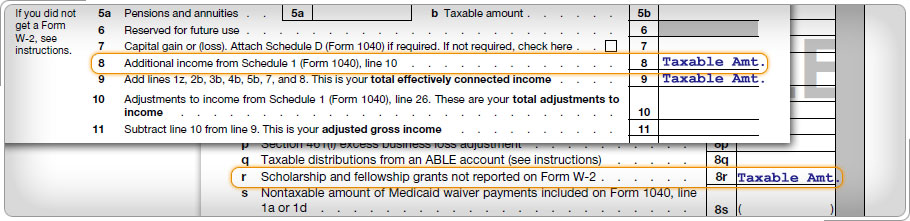

Preparing Form 1040-NR (continued)Scholarships and Fellowship GrantsNonresident students must report all scholarships they receive for room and board and living expenses that are not exempted by their treaty. Scholarships that cover only tuition, books, and fees are not reported. Scholarships from outside the U.S. are not reported either. If the student uses part of a reportable scholarship to pay for tuition, books, fees or supplies, these expenses can be excluded from the Scholarship and Fellowship grants not reported on Form W-2 line, Schedule 1 (1040) that flows over to Form 1040-NR, Other income from Schedule 1.

|