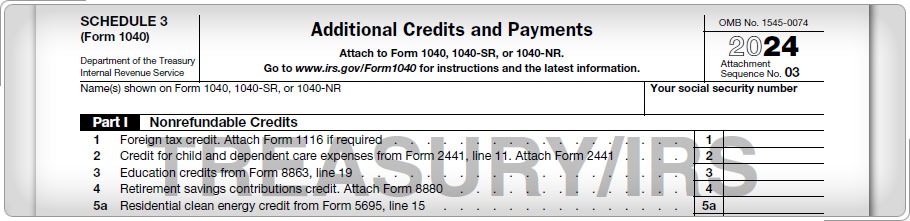

Intake/Interview & Quality Review SheetA nonrefundable credit can only reduce the tax liability to zero. All the credits discussed in this lesson are nonrefundable credits. Generally, nonrefundable credits are applied against federal tax in the order they are listed on Form 1040, Schedule 3, Nonrefundable Credits. Use the information from the taxpayer's intake and interview sheet, along with the documents provided by the taxpayer, to determine eligibility for these credits. Click here to review Form 13614-C, the Intake/Interview & Quality Review Sheet.

|