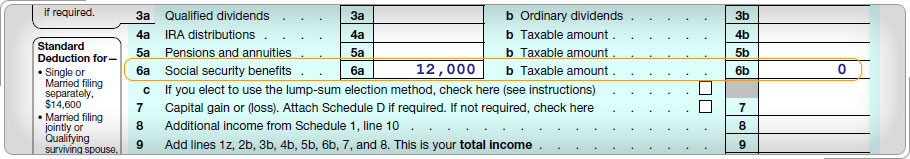

Case Study 2: Income LimitsJohn, who is 67 years old, is unmarried and will file as Single. He received $12,000 in nontaxable Social Security benefits in the tax year. His AGI is $9,000. Is he eligible to claim the credit for the elderly or the disabled? Click here for an explanation. Even though John is a qualified individual, he is not eligible to claim the credit since his nontaxable Social Security benefits exceed $5,000. This information is found in the Credit for Elderly or Disabled — Screening Sheet, Figure B. Income Limits, in the Volunteer Resource Guide, Nonrefundable Credits tab, and on page 1 of the Instructions for Schedule R.

|