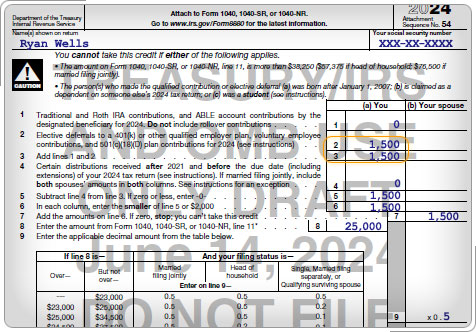

Case Study 2: Determining the Amount of the CreditOur volunteer is working with taxpayer, Ryan Wells, who is 28 years old. Ryan, who is not a full-time student, is filing as Single, has an AGI of $24,000, and has contributed $1,500 to a 401(k) during the tax year. He has not received any distributions during the tax year or the two prior years. After asking Ryan about distributions, the volunteer fills in the required information. Click here to review Ryan's Form 8880.

|