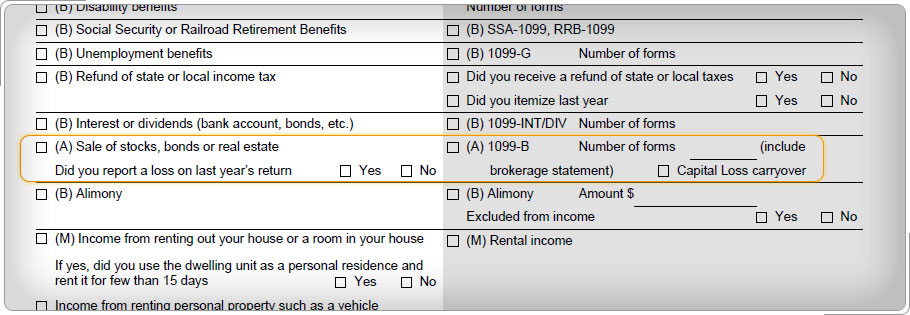

Intake/Interview & Quality Review SheetTo determine if the taxpayer must report the sale of investments or the sale of a home, use Form 13614-C, Intake/Interview & Quality Review Sheet to ask questions and get the necessary information to ensure an accurate return. The intake and interview sheet lists income from the sale of property such as stock, bonds, or real estate. It is important to ensure that all income is accurately reported on the return. Ask taxpayers if they sold any stock, securities, other investment property, or a home during the tax year. The intake and interview sheet asks about income from the sale of property such as stock, bonds, digital assets, or real estate. Ask taxpayers if they sold any stock, securities, or other investment property; also ask if they sold any real estate, such as their principal residence or "main home" during the tax year. They may be eligible to exclude all or part of the gain from the home sale from taxable income. Transactions involving digital assets are out of scope. A digital asset is a digital representation of value that is recorded on a cryptographically secured, distributed ledger, or any similar technology. Common digital assets include virtual currency and cryptocurrency, stablecoins, and non-fungible tokens. Examples of digital assets transactions include:

If the taxpayer can check the "No" box on Form 1040, the return is in scope. Refer to Scope of Service in Publication 4012, VITA/TCE Resource Guide, and Instructions for Form 1040 for details on digital assets. Part V Life Events of the intake and interview sheet asks: 8. (A) File a federal return last year containing a "capital loss carryover" on Form 1040 Schedule D?

|