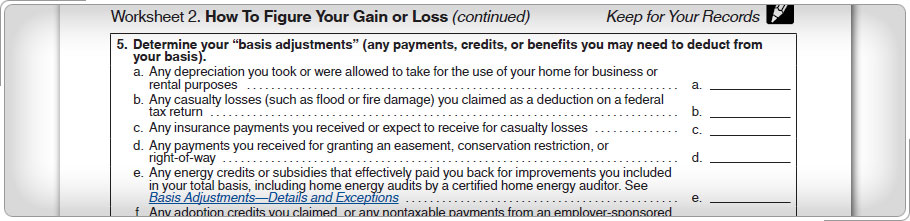

Case Study 2: Exclusion LimitPhilip and Betty Clark sold their home and the amount realized is more than the adjusted basis. The selling price minus the selling expenses is the amount realized. Subtract the adjusted basis from the amount realized to get the gain or loss. Once you've determined the gain or loss on the sale of the taxpayer's home, then figure the exclusion of any taxable gain from the sale. Use the How to Figure the Taxable Gain or Loss Worksheet 2 from Publication 523, to figure the taxable gain. If all requirements are met and the taxpayers and their filing status is filing Married Filing Jointly, how much may they exclude? Click here for an explanation. If all the requirements are met, an individual taxpayer may exclude up to $250,000 of the gain from taxable income; taxpayers who use the Married Filing Jointly filing status and some surviving spouses may exclude up to $500,000.

|