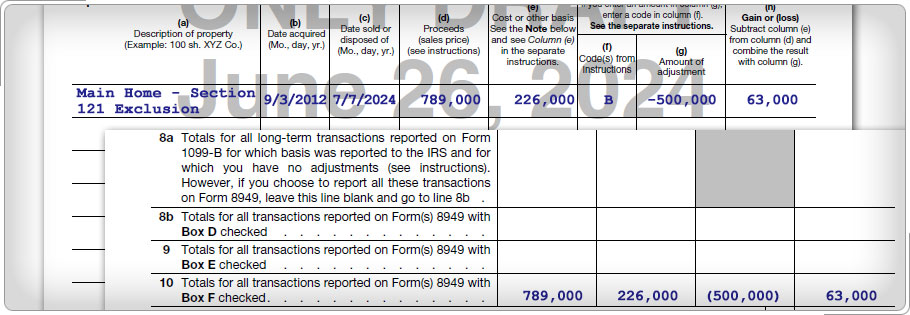

Case Study 1: Reporting Gain from the Sale of a HomeA taxpayer acquired a home in 2015 and sold it in 2025. Review the Schedule D Capital Gain or Loss Transactions Worksheet from the Volunteer Resource Guide, Tab D, Income, to determine how to report the taxable gain and exclusion amount for the sale of a main home. Should the proceeds from the sale of a main home that meets the ownership and use tests must be reported if the gain is greater than the taxpayer's allowed exclusion? Click here for an explanation. Proceeds from the sale of a main home that meets the ownership and use tests must be reported if the gain is greater than the taxpayer's allowed exclusion; only the excess must be reported. Gain from the sale of a home that is not the taxpayer's main home will generally have to be reported as income. In both cases, the gain is taxable. The sale must be reported on Form 8949 and Schedule D. If the home was used for business purposes or as rental property, the gain would be reported on Form 4797 and the taxpayer should be referred to a professional tax preparer.

|