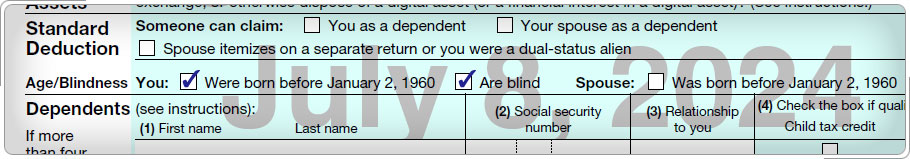

Case Study 1: Older than 65 and BlindSherman is 73 years old and blind. He files as Single using Form 1040. Because Sherman is over 65 and blind, check the appropriate box on Form 1040 or Form 1040-SR. What is his standard deduction? Click here for an explanation. The standard deduction is higher if the taxpayer is 65 or older. It is also higher if the taxpayer is blind. Use the Standard Deduction for People 65 or Older or Who are Blind Chart to apply these rules and to calculate the amount of the taxpayer's standard deduction. Sherman's standard deduction would be $17,000. Information about age and blindness are reported in the check boxes located on Form 1040 or Form 1040-SR. The more check boxes marked, the higher the standard deduction.

|