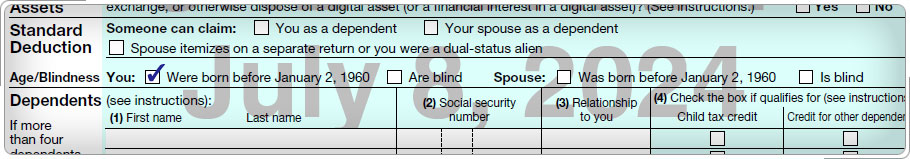

Case Study 3: Who qualifies as 65 or older?Tim is 67 and is filing as Single. He is not blind and he cannot be claimed as a dependent on someone else's return. What is Tim's standard deduction? Click here for an explanation. Tim is entitled to the regular standard deduction for single ($15,000) plus an additional amount for being older than 65 ($2,000). He can take a standard deduction of $17,000. This amount can be found using the Standard Deduction for People 65 or Older or Who are Blind Chart in the Volunteer Resource Guide, Tab F, Deductions.

|