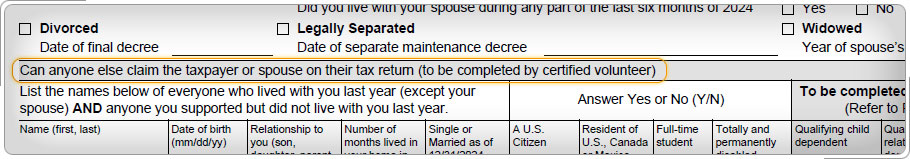

Case Study 1: Taxpayers Who Can Be Claimed as DependentsJanet is single, 22, a full-time student, and not blind. Her parents claimed her as a dependent on their current year tax return. On the intake and interview sheet, Janet marked the check box for a dependent being claimed by another taxpayer. She has no itemized deductions, so you will compute her standard deduction using the Standard Deduction Worksheets for Dependents. Click here for an explanation. The standard deduction is generally lower for an individual who can be claimed as a dependent on another person's tax return. Taxpayers that can be claimed as a dependent must use the Standard Deduction for Dependents Worksheet to determine their standard deduction. The worksheet can be found in the Volunteer Resource Guide, Tab F, Deductions.

|