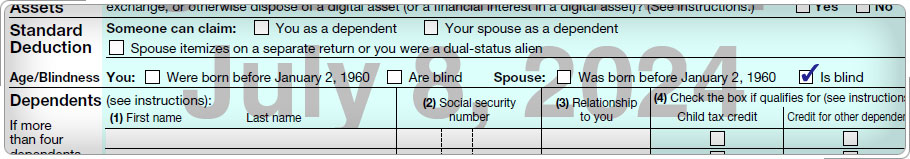

Case Study 4: What if only one spouse is over 65 or blind?Kevin and Jane are both 60, and Jane is blind. They are filing as Married Filing Jointly. Neither can be claimed as a dependent on someone else's return. What is the standard deduction for Kevin and Jane? Click here for an explanation. They are entitled to the regular standard deduction for Married Filing Jointly ($30,000) plus an additional amount for being blind ($1,600). Kevin and Jane can take a standard deduction of $31,600. This amount can be found using the Standard Deduction for People 65 or Older or Who are Blind Chart in the Volunteer Resource Guide, Tab F, Deductions.

|