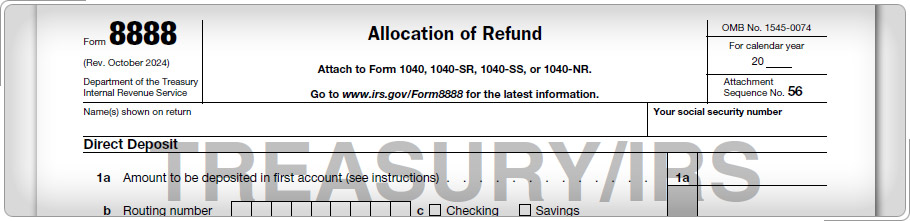

Case Study 1: Errors that Affect the RefundJoan's return shows a refund of $300 and she asks the IRS to split her refund among three accounts with $100 to each account. Due to an error, her refund is decreased by $150. The IRS will adjust her direct deposits as follows:

Click here for an explanation. If an adjustment results in a smaller refund than indicated on the return, the IRS applies a bottom-up rule and deducts the difference from the direct deposit amount designated for the last account shown on Form 8888. If the difference exceeds the amount designated for the last account, the IRS deducts the remainder from the amount designated to the next account, until the amount due is paid.

|