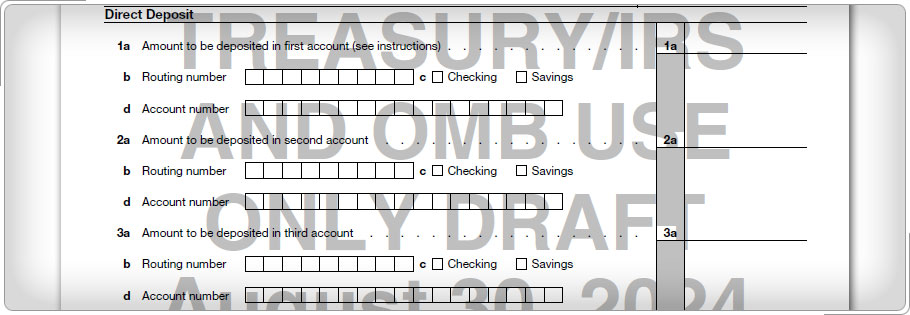

Case Study 1: OffsetsBill asks that his refund of $780 be deposited into three different accounts: $300 into Account 1, $300 into Account 2 and $180 into Account 3. However, Bill owes federal taxes of $290 from an earlier tax year. After this amount is offset, the balance of $490 will be direct deposited as follows: Account 1 will receive $300, Account 2 will receive $190, and Account 3 will receive $0. Click here for an explanation. The IRS applies the same bottom-up rule to adjust direct deposits for refund offsets for unpaid federal taxes.

|