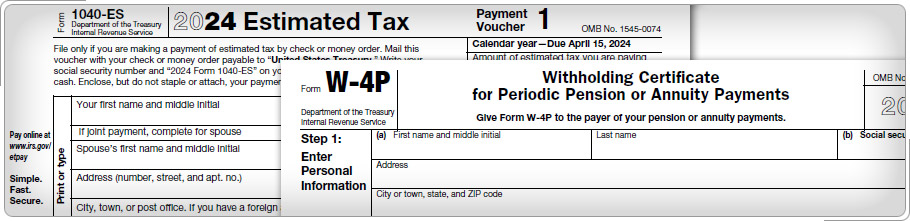

Case Study 1: Estimated Tax PaymentsMaria is retired, and her only income is from a pension and some investments. She had no withholding and is not eligible for any tax credits. When you complete her return this year, she has a balance due of $1,300. Maria should begin making estimated payments, since her balance due next year will be more than $1,000, and she has no withholding. If Maria does not want to make estimated payments, she could submit Form W-4P to request withholding from her pension instead. Click here for an explanation. Taxpayers with significant income that is not subject to withholding (such as investments, interest, dividends, capital gains, or self-employment income) will often find they need to make estimated tax payments. The decision tree in Publication 17, Your Federal Income Tax for Individuals, and Publication 505, Tax Withholding and Estimated Taxes can help determine if the taxpayer should make estimated tax payments. Use Form 1040-ES, Estimated Tax for Individuals to compute the amount of estimated tax that should be paid over the year. This form includes worksheets to help taxpayers estimate their income and tax liability for the year.

|