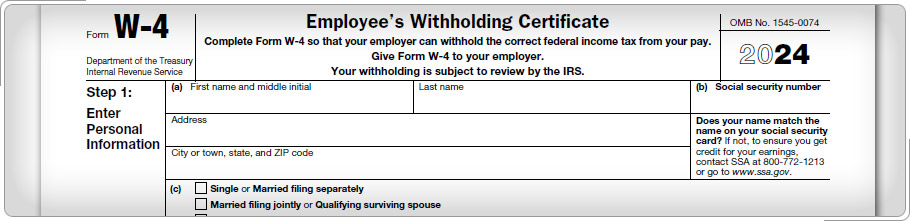

Case Study 1: Form W-4Mary claimed her son as a dependent on this year's return. Mary will not be able to claim her son as a dependent on next year's return. Mary will change her Form W-4 to increase her withholding by reducing the number of dependents she claims and submit it to her employer. Click here for an explanation. Taxpayers may submit a new Form W-4 whenever they want to increase or decrease the withholding amount. Life events such as a change in marital status, birth of a child, change of a child's dependence status, or purchase of a home will change adjustments, deductions, and credits on the tax return. These taxpayers should submit a revised Form W-4 to their employer.

|